6777 7775

Sim Lim Tower, 10 Jalan Besar Sim Lim Tower #01-01, 208787

Apply for a Business Loan in Singapore

Monetium Credit is one of the top licensed moneylenders in Singapore. We can offer you a business loan interest rate ideal for your requirements.

What Is a Business Loan Singapore?

It is a financial instrument offered by private lenders and national financial entities. It is used exclusively to help organizations run their operations or commence their activities. An effective interest rate and flexibility characterizes it, so its popularity among the public has increased in recent years.

Small business loans can be used as working capital to ensure the development of the firm you want to invest in, or they can, at the same time, provide a cash infusion needed to purchase the equipment that will help keep the business going. Getting a loan for startup business can be a wise choice as the repayment terms of such financial arrangements are usually advantageous and suitable for most individuals.

Standard Loan

This is suitable for different size organizations and can be used to purchase equipment and expand business. Such a loan, obtained from a licensed lender in Singapore, is ideal in any situation and is characterized by attractive interest rates.

SME Loan

A Singapore SME loan is designed for small to medium-sized businesses that do not benefit from the revenue streams inherent in international enterprises. This can be used for expansion, the purchase of professional equipment, the diversification of products sold, or the recruitment of skilled staff.

Start-Up Loan

This is mainly used for companies at the beginning of their professional journey, needing a loan to cover the costs associated with day-to-day operations. These are characterized by flexible repayment options but may require collateral.

Monetium Credit is the Best Licensed Moneylender in Singapore

Monetium Credit is one of one hundred and fifty legal moneylenders in Singapore. Our financial services are aimed at private individuals and businesses with experience in our country’s market. We can offer you a favourable interest rate tailored to your business’s needs and a loan amount to help you achieve your ambitions.

We are the perfect legal moneylender in Singapore for your needs. We can help your startup business succeed. Moreover, we offer a simplified application process for the financial services we market, and we are confident that our staff can assist you with your questions.

Business loan to fuel up your business

Business aspirations deserve to be materialized to their pinnacles of potential. As a licensed money lender offering different loans for years, Monetium Credit understands the importance of turning your aspirations into a career and sustaining steady revenue growth to solidify and build your business to fuel the other important matters of your life, such as family and ambitions. This is why we have combined all our expertise and experience to provide you with the best business loans in Singapore to bring that budding entrepreneur to life.

From traditional Business Loans, SME Loans, Start-Up Business Loans, and Equipment & Machinery Financing to more modern and efficient services such as Merchant Cash Advance and invoice Factoring Loans, you can be assured that if there is any aspect of a business empire or an acquisition hurdle, Monetium Credit has the best available solutions for you to continue working towards establishing a rock-solid business foundation.

Who is eligible?

For Fixed Salary Employees

- Singapore Citizen, Permanent Resident: Above Age: 21

- Employment Status: Full-time or Part-time

Documents required:

- Identity proof: NRIC / Passport

- Income proof: Computerised payslip / CPF / Bank statement

- Residency proof: Household bills

- Employment contract (For new employment less than 6 months)

Disclaimer: We reserves the right to request for other documentary materials and proofs on a case-by-case basis.

What Documents Should I Prepare for a Loan Contract?

- Singapore Citizen, Permanent Resident: Above Age: 21

- Employment Status: Full-time or Part-time

Documents required:

- Identity proof: NRIC / Passport

- Income proof: Computerised payslip / CPF / Bank statement / Income Tax

- Residency proof: Household bills

- Employment contract (For new employment less than 6 months)

Disclaimer: We reserves the right to request for other documentary materials and proofs on a case-by-case basis.

What Happens After the Loan Approval Process is Completed Successfully?

You are eligible if you are a business owner who may or may not be part of the following:

- A sole proprietorship, or Limited Liability Partnership (LLP)

- A private limited company

- A corporation

Documents required:

- Identity proof: NRIC / Passport

- Income proof: Company payslip / Income Tax / CPF

- ACRA Document

- Minimum 2 months of company bank statements

- Corporate and income Tax assessment

Monetium Credit Offers the Best Loans for Companies!

You can call us anytime or visit our physical location at 10 Jalan Besar Sim Lim Tower #01-01, 208787.

4 Reasons to Take Out a Business Loan in Singapore

Grab a business opportunity

Did you find an opportunity to pursue your professional ambitions? If so, Monetium Credit can offer you a suitable loan amount to finance your dreams.

Start Business Expansion

Are you the owner of a startup business in Singapore? Then, with the help we can offer, you could expand your venture and obtain a loan amount that fits your requirements.

Solve a Cash Emergency

We can offer you a financial package with an effective interest rate and a loan amount that will solve the economic problem you are currently going through.

Extend a Credit Line

Do you require a DCL? A cash infusion for your start-up business? Or just a loan that will make your ambitions a reality? If so, we at Monetium Credit can be your greatest allies.

How can you obtain a Business Loan?

Business loans vastly differ from Personal or Lifestyle services. This is due to the nature of different business demands and industry. Therefore, you may still submit your applications online; however, in order to assist us to expedite the process for you, presenting your application at the branch itself will be an immense advantage.

Limitations & Requirements of a Business Loan

Generally, loans for businesses are granted with significantly higher principal amounts. Whether you’re looking to stabilize, rebuild or execute a business project from scratch, our credit company in Singapore have a series of well-crafted proposals to ensure that your operations succeed in the best way possible with the least amount of collateral. The only varying aspect of this option would be the nature of the required supporting documents. Following which service you seek, required documents may be needed in the forms of ACRA certs, Balance sheets, or Incorporation details.

If you want a business loan, please submit your details here. Rest assured that your online application will be processed as soon as possible.

Loan Options From Monetium Credit

Personal Loan

A type of financial package suitable for personal purchases or investments in the requirements of loved ones. At Monetium Credit, we can offer a personal loan with a fantastic interest rate and a flexible repayment schedule.

Payday Loan

Life in Singapore is expensive, and you may need an influx of capital. A higher interest rate, which will not exceed 4% per month, can accompany this financial instrument. Moreover, the loan amount will be lower than other options.

Lifestyle Loan

Do you need a vacation? Have you got your eye on jewellery or a new phone? A lifestyle loan can be a perfect financial instrument for subjective requirements, as these credits are used for miscellaneous purchases.

Renovation Loan

These financial instruments are used for housing renovation projects. Do you need a significant loan to cover your bedroom remodelling work? Are you looking for an advantageous interest rate and a flexible repayment schedule? Then, such a credit is an excellent choice.

Debt Consolidation Loan

Do you have credit card debt and need help paying off a previous loan? Then, a DCL can be a flexible financial instrument with an advantageous interest rate that can streamline your existing payments and make them more manageable.

Mortgage Loan

Extended repayment terms and significant loan amounts characterize this financial instrument. Are you looking for a long-term loan with an excellent interest rate to help you realize your dream of being a homeowner? Then, a mortgage is a must.

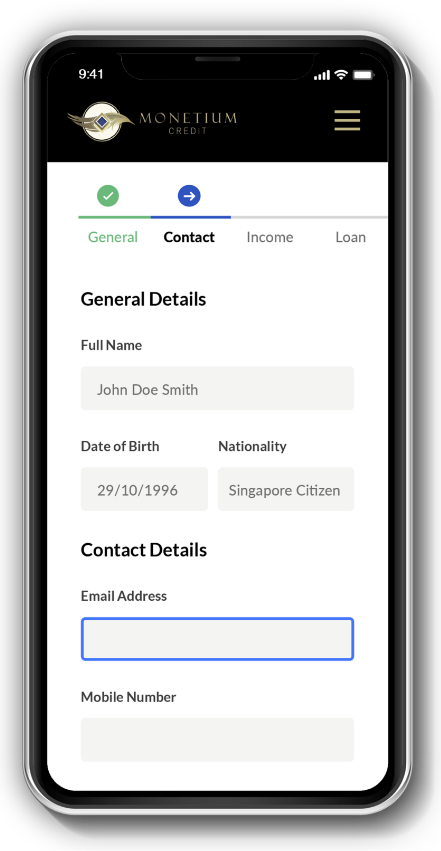

A 3 Steps Application Process

Online Application

The process starts by submitting an application form in which you will specify the loan amount you wish to obtain and provide standard information such as your employment status, full name, and whether you are a resident or a foreign national.

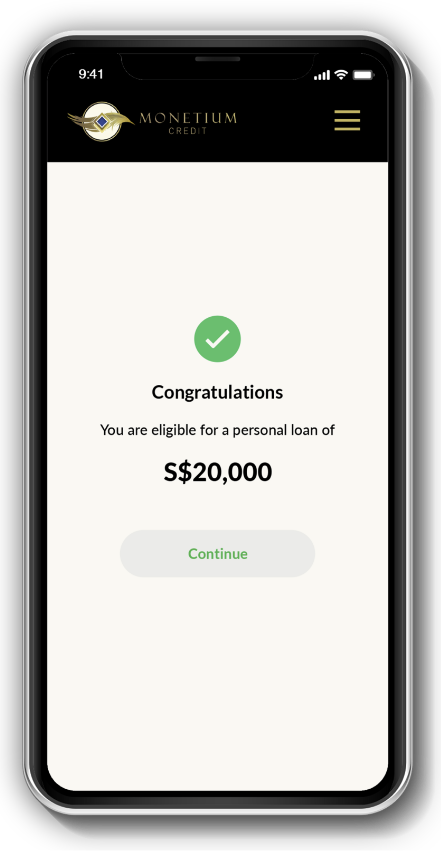

Verification & Approval

Once you submit this application form through our online platform, our agents will inspect it, along with any additional documents we may require, and provide you with a response to your loan request in less than 48 hours.

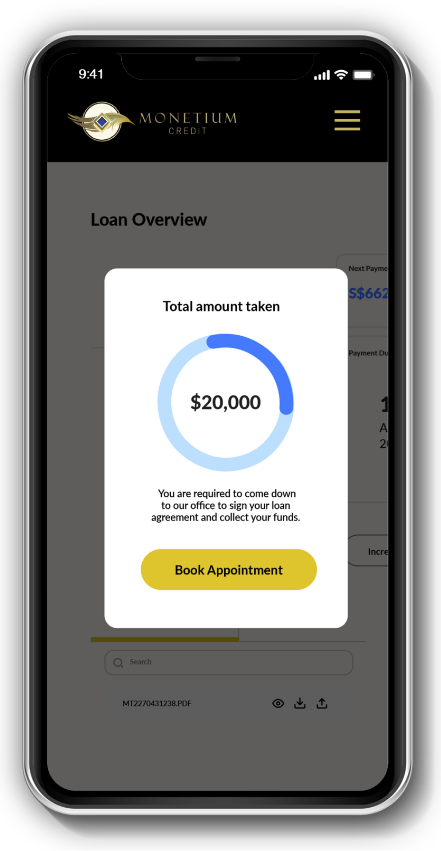

Releasing Funds

Upon approval, you will visit the agency’s office, where you can sign all needed documents and pick up the amount borrowed in cash.

Quick Links

Login to your bank’s PayNow App & Scan the QR Code to make Payment

Monetium Credit (S) Pte Ltd (201326118D)

DBS Current Account

Copyright @ 2024 Monetium Credit (s) Pte Ltd. All Rights Reserved. License No 147/2023.

Disclaimer | Privacy Policy | Responsible Borrowing

Monetium Credit (s) Pte Ltd (UEN No. 201326118D) is a registered company under the laws of Singapore. Customers are strongly advised to take a look at our privacy policy & disclaimer sections. If you have any queries or concerns in regards to personal data, please kindly contact [email protected]